Share Article

Total Revenues Increased 16 Percent over Prior Year

Foster City, CA -- January 25, 2001

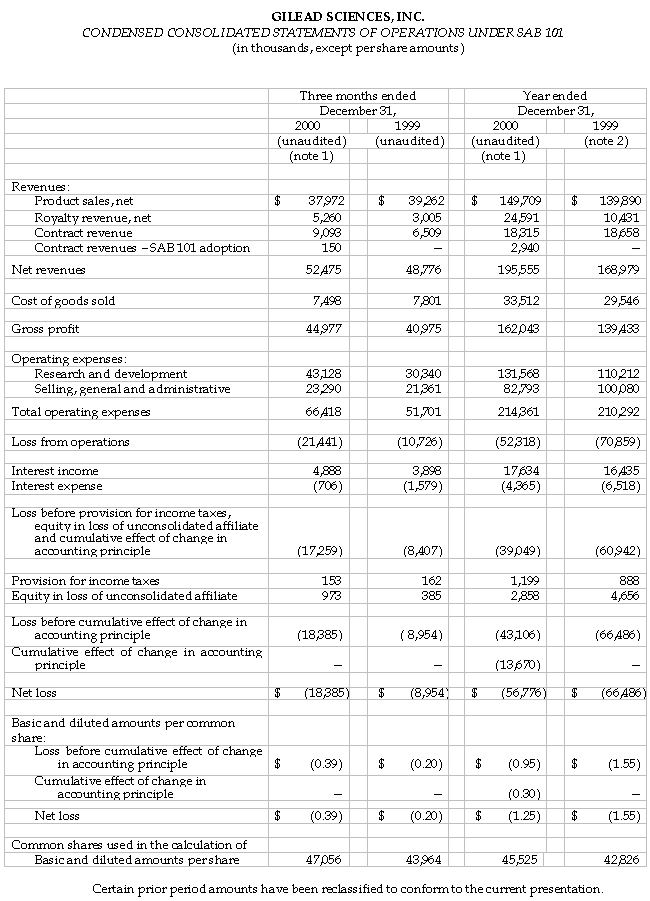

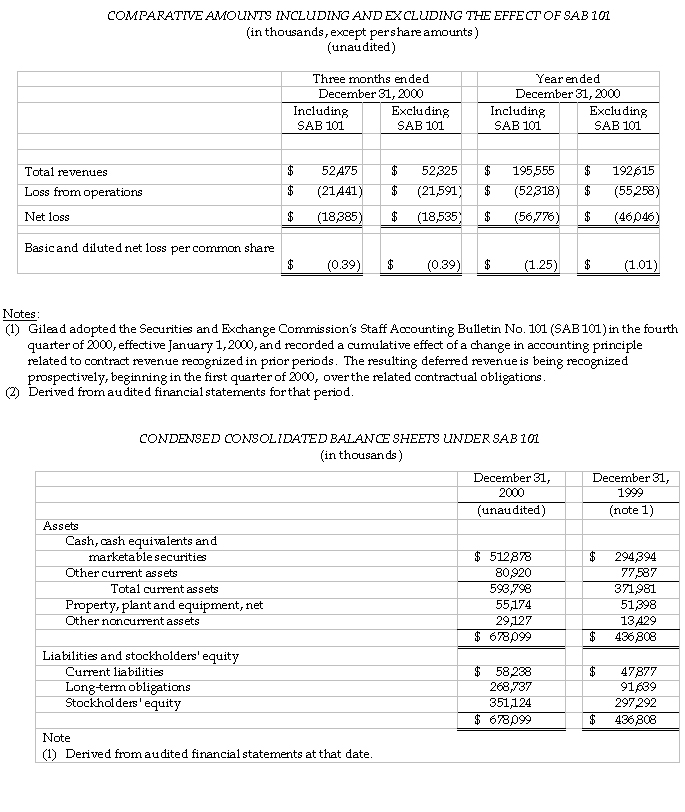

Gilead Sciences, Inc. (Nasdaq: GILD) announced today its results of operations for the fourth quarter and year ended December 31, 2000. Gilead today is reporting its transition from the company’s historical accounting method to the method preferred by the Securities and Exchange Commission Staff as set forth in Staff Accounting Bulletin 101 (SAB 101).

For the fourth quarter, Gilead recorded revenues from net product sales of $38.0 million, royalty revenues of $5.3 million and contract revenues of $9.2 million, including contract revenues of $150,000 due to the adoption of SAB 101. Total revenues for the fourth quarter ending December 31, 2000 were $52.5 million, which represents an eight percent increase over the same quarter in 1999. For the fourth quarter of 1999, total net revenues of $48.8 million included net product sales of $39.3 million, royalty revenues of $3.0 million and contract revenues of $6.5 million.

The net loss for the three months ended December 31, 2000, was $18.4 million, or $0.39 per share. The net loss for the fourth quarter 2000 compares to a net loss of $9.0 million, or $0.20 per share, for the same quarter in 1999.

Net revenues from product sales were primarily derived from sales of AmBisome® (amphotericin B) liposome for injection, accounting for 94 percent of product revenues for the fourth quarter of 2000. AmBisome sales for the fourth quarter of 2000 were $35.6 million, a decrease of two percent compared to the fourth quarter of 1999. Excluding the impact of the decline in foreign currencies relative to the U.S. dollar, AmBisome sales grew by 11 percent for the fourth quarter of 2000 over the comparable quarter of 1999. In addition, Gilead recorded product revenues of $1.2 million and $1.1 million from the sale of VISTIDE® (cidofovir injection) and DaunoXome® (daunorubicin citrate liposome injection), respectively, during the fourth quarter of 2000.

For the fourth quarter of 2000, royalty and contract revenues resulting from collaborations with corporate partners totaled $14.5 million. These revenues include contract revenues for research and development projects, royalties on product sales of AmBisome in the United States by Gilead’s co-promotion partner Fujisawa Healthcare, royalties on sales of Tamiflu™ (oseltamivir phosphate) by Hoffmann-La Roche, and royalties on product sales of VISTIDE outside the United States by Pharmacia & Upjohn. Also included are contract revenues related to the adoption of SAB 101.

Research and development (R&D) expenses for the fourth quarter of 2000 were $43.1 million, compared to $30.3 million for the same quarter in 1999. Higher spending during the fourth quarter of 2000 was associated with the accelerated development and advanced nature of the Phase III clinical programs for both tenofovir DF for HIV and adefovir dipivoxil for hepatitis B virus (HBV). Additionally, in the fourth quarter of 2000, Gilead in-licensed two oncology compounds, one from GlaxoSmithKline and one from Southern Research Institute, and made up-front payments to both parties that are included in research and development expenses. Selling, general and administrative (SG&A) expenses for the three months ended December 31, 2000, were $23.3 million, compared to $21.4 million for the same quarter of 1999.

Net interest income for the fourth quarter 2000 was $4.2 million, compared to $2.3 million for the same quarter in 1999. The increase was primarily due to the conversion of Gilead’s outstanding debentures to common stock in the third quarter of 2000 and higher interest rates on the investment portfolio.

Gilead also reported its results of operations for the year ended December 31, 2000. The company recorded net revenues from product sales of $149.7 million and aggregate contract and royalty revenues of $45.8 million, which includes contract revenues of $2.9 million relating to the adoption of SAB 101. Accounting for 94 percent of product sales, AmBisome sales for the year 2000 were $141.1 million, a nine percent increase over 1999. Excluding the impact of the decline in foreign currencies relative to the U.S. dollar, AmBisome sales grew by 21 percent in 2000 over 1999. Net revenues of $195.6 million in 2000 compare to net revenues of $169.0 million in 1999. Net revenues for 1999 included product sales revenues of $139.9 million and aggregate contract and royalty revenues of $29.1 million.

The net loss for the year ended December 31, 2000, including the impact of SAB 101, was $56.8 million, or $1.25 per share. Excluding the effect of the change in accounting principle, the net loss for 2000 would have been $46.0 million, or $1.01 per share. This compares to a net loss of $66.5 million, or $1.55 per share for the year ended December 31, 1999, which included expenses associated with the merger with NeXstar Pharmaceuticals, Inc. of $18.3 million or $0.42 per share. Excluding these merger-related expenses, Gilead’s loss for the year ended December 31, 1999, would have been $1.13 per share.

“Results for the year continue to show the strength in Gilead’s portfolio of marketed products,” said John C. Martin, Ph.D., President and Chief Executive Officer, Gilead Sciences. “Revenues for the year 2000 continued to be fueled by AmBisome’s growth, which achieved a nine percent growth rate year-over-year. We expect the recent approvals expanding Tamiflu’s use for prevention and pediatric care will contribute to strong revenue growth in 2001.”

Research and development expenses for the years ended December 31, 2000 and 1999, were $131.6 million and $110.2 million, respectively. Major development projects in 2000 include Phase III clinical programs for both tenofovir DF for HIV and adefovir dipivoxil for HBV. Higher spending was associated with the accelerated development and advanced nature of these programs. In addition, Gilead in-licensed two oncology compounds, one from GlaxoSmithKline and one from Southern Research Institute, and made up-front payments to both parties.

Selling, general and administrative expenses for the year ended December 31, 2000, were $82.8 million compared to $100.1 million for 1999. The decrease in SG&A expenses for 2000 is due to merger costs of $18.3 million that were included in SG&A expenses in 1999.

Net interest income for the year ended December 31, 2000 was $13.3 million, compared to $9.9 million for 1999. The increase was primarily due to the conversion of Gilead’s outstanding debentures to common stock in the third quarter of 2000 and higher interest rates on the investment portfolio.

The company also reported equity in the loss of its unconsolidated affiliate of $2.9 million and $4.7 million for the years ended December 31, 2000 and 1999, respectively. The losses are derived from Gilead’s 49 percent interest in Proligo L.L.C., a manufacturing joint venture between Gilead and SKW Americas, Inc.

As of December 31, 2000, the company had cash, cash equivalents and marketable securities of $512.9 million, compared to $294.4 million on December 31, 1999. The increase is primarily due to the issuance of $250 million of convertible subordinated notes in December 2000.

Products and Pipeline Highlights

“The fourth quarter was very productive and exciting for Gilead. Tamiflu received three major approvals, we initiated three clinical studies for NX 211 and in-licensed two new oncology products. Additionally, the completion of the 24-week endpoint for one of our pivotal tenofovir studies marks a milestone in the development of this important anti-HIV compound,” said Dr. Martin. “We remain dedicated to achieving vigorous commercial growth. In line with our vision, we renegotiated the terms of our licensing agreement for tenofovir DF and adefovir dipivoxil, completed a $250 million financing and our Board of Directors authorized an increase in authorized capital, subject to stockholder approval, in order to implement a two-for-one stock split.”

AmBisome® (amphotericin B) liposome for injection for Severe Fungal Infection

In November, the Journal of Clinical Infectious Diseases published results of a multi-center head-to-head study comparing the use of AmBisome to Abelcet® (amphotericin B) lipid complex in the empirical treatment of patients with febrile neutropenia. Results indicate that AmBisome demonstrates an improved safety profile in a direct comparison with Abelcet with regard to nephrotoxicity and infusion-related reactions.

Also during the quarter, AmBisome was cleared for marketing in Norway and Singapore. Italian regulatory authorities approved AmBisome for the treatment of cryptococcal meningistis in AIDS patients, and French regulatory authorities provided clearance for use of AmBisome for the empirical treatment of febrile neutropenic patients.

Tamiflu™ (oseltamivir phosphate) for Influenza

In the fourth quarter of 2000, Roche received three significant marketing approvals for Tamiflu, the first neuraminidase inhibitor available in pill form. First, the U.S. Food and Drug Administration (FDA) approved Tamiflu for the prevention of naturally occurring influenza A & B in adults and adolescents 13 years and older. The FDA also granted marketing approval of Tamiflu, available in a liquid suspension, for the treatment of influenza in children one year and older. The suspension for pediatric patients can also be used for adults who cannot swallow a capsule. In addition, Roche received approval for Tamiflu in Japan for the treatment of influenza A and B virus infection in adults and reimbursement under the Japanese national health insurance program. Roche will make Tamiflu available in pharmacies and hospitals in Japan on February 2, 2001.

Tenofovir disoproxil fumarate (tenofovir DF) for HIV

Tenofovir DF reached an important milestone in November when the last patient enrolled in Study 907 reached the 24-week timepoint. Preliminary analysis of the 24-week results from this study will be released in the first quarter of 2001. Study 907 is a Phase III intensification trial evaluating the safety and efficacy of tenofovir DF in 552 treatment-experienced patients. Additionally in November, the U.S. FDA granted tenofovir DF Fast-Track designation.

In October, data from the 48-week Study 902 further characterizing the viral resistance profile of tenofovir DF were presented at the 5th International Conference on Drug Therapy in HIV Infection held in Glasgow, Scotland. The data indicate that the addition of tenofovir DF resulted in a significant reduction in HIV RNA in treatment-experienced patients with common viral mutations associated with thymidine analog (AZT/d4T) and/or 3TC viral mutations.

Adefovir Dipivoxil for HBV

Two significant milestones were achieved during the fourth quarter in the development of adefovir dipivoxil, Gilead’s investigational compound for the treatment of patients with chronic HBV infection. The People’s Republic of China State Drug Administration approved Gilead’s clinical trial application for adefovir dipivoxil allowing Phase I studies in China to be initiated in 2001. Gilead was granted Class 1 designation for adefovir dipivoxil in December 1999, which provides for 12 years of market upon receipt of marketing authorization.

At the 51st American Association for the Study of Liver Diseases in Dallas, Texas, Gilead announced results from an ongoing open-label pilot study evaluating the safety and efficacy of adefovir dipivoxil 10 mg once daily as a treatment for lamivudine-resistant chronic HBV infection in 35 patients co-infected with HIV and HBV. Preliminary results from this 12-month study show that treatment with adefovir dipivoxil 10 mg once daily is associated with a mean decrease in HBV DNA of 3.40 log10 copies/mL at 24 weeks. Gilead is currently conducting two fully enrolled, placebo-controlled Phase III clinical trials to evaluate adefovir dipivoxil as a potential treatment for chronic HBV in non-HIV infected patients.

Oncology Program

In November, Gilead initiated its first Phase II clinical trial program of NX 211 with a study designed to evaluate its safety and efficacy in patients with relapsed ovarian cancer, followed shortly by the initiation of a second study in ovarian cancer patients who are resistant to treatment with topotecan. In addition, the company initiated a Phase II trial designed to evaluate the anti-tumor efficacy and safety of NX 211 in patients with recurrent small cell lung cancer. NX 211 is a liposomal formulation of lurtotecan, a novel topoisomerase I inhibitor for the potential treatment of various solid tumors.

Gilead also made significant progress in the fourth quarter in building its oncology portfolio through the in-licensing of two oncology compounds. First, the company entered into an agreement with GlaxoSmithKline granting Gilead exclusive, worldwide rights to GW1843U89, an investigational thymidylate synthase (TS) inhibitor for the potential treatment of cancer, which had progressed into a Phase I clinical trial. Gilead has reformulated the compound as a liposomal agent called GS 7904L and initiated preclinical development, with the goal of submitting an Investigational New Drug Application for the product before the end of 2001.

In December, Gilead announced a licensing agreement with the Southern Research Institute granting Gilead exclusive worldwide development and marketing rights to 4’-thio-araC (GS 7836), a nucleoside analogue for the potential treatment of cancer. Gilead plans to initiate Phase I clinical trials of this compound in early 2002.

Corporate Activities

Gilead’s Board of Directors approved an increase in the number of authorized shares of common stock from 100,000,000 to 500,000,000. Gilead plans to hold a Special Meeting of the Stockholders on February 2, 2001 to vote upon this increase in common stock. The primary purpose of the increase is to enable the Board to implement a split of the company’s common stock, to be effected in the form of a stock dividend. Earlier this month, the Board approved a two-for-one stock split, subject to stockholder approval of the increase in common stock. The proposed increase in authorized shares would also provide Gilead with flexibility to implement future stock splits and conduct other transactions involving the issuance of the company’s common stock, where appropriate.

In December, Gilead issued $250 million of convertible subordinated notes through a Rule 144A offering to qualified institutional buyers. These notes are convertible into Gilead common stock at a price equal to $98.25 per share, subject to adjustment in certain circumstances. The notes bear interest at 5.0 percent per annum, have a seven-year term and are redeemable by Gilead any time after December 20, 2003. Gilead has agreed to file a registration statement for the resale of the notes and the shares of common stock issuable upon conversion of the notes within 90 days after the closing of the offering.

Conference Call

Gilead will host a conference call today, January 25, 2001, at 4:30 p.m. ET. The dial-in number for the call is 800-633-8620 domestic; 212-676-4902 international. The replay of this call will be available from 7:00 p.m. January 25, 2001, until 7:00 p.m. on January 28, 2001. The dial-in number for the replay is 800-633-8284 domestic, 858-812-6440 international; the password is 17337262.

Gilead will also be webcasting the conference call; this feature will be available on our website at www.gilead.com. The information provided on the teleconference and on the webcast is only accurate at the time of the call, and Gilead will take no responsibility for providing updated information.

About Gilead

Gilead Sciences, Inc., headquartered in Foster City, CA, is an independent biopharmaceutical company that seeks to provide accelerated solutions for patients and the people who care for them. Gilead discovers, develops, manufactures and commercializes proprietary therapeutics for challenging infectious diseases (viral, fungal and bacterial infections) and cancer. Gilead maintains research, development or manufacturing facilities in Foster City, CA; Boulder, CO; San Dimas, CA; Cambridge, UK, and Dublin, Ireland, and sales and marketing organizations in the United States, Europe and Australia.

Forward-looking Statements

Statements included in this press release that are not historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include those regarding Gilead’s future financial results, including: revenues, research and development expenses, selling, general and administrative expenses, the efficacy of any marketed or pipeline development products, the ability to obtain marketing approval for Gilead’s marketed or pipeline development products, or the competitive positioning of its marketed or pipeline development products. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties, which could cause actual results to differ materially. These risks and uncertainties include those that can cause fluctuations in our financial results, such as our ability and the ability of our partners to successfully market our products and maintain revenue growth; our ability to control the timing and amount of spending in our research and clinical programs; fluctuations in foreign currency against the U.S. dollar; our ability to achieve and the timing of milestones, as well as risk and uncertainties that effect our future prospects such as the risk that we may not continue to observe the safety, tolerability and efficacy data for our products and product candidates that we are observing today; other risks relating to the regulatory approval of our products and product candidates; and other risks identified from time to time in the company’s reports filed with the U.S. Securities and Exchange Commission. The company directs readers to its Annual Report on Form 10-K, for the year ended December 31, 1999, filed in March 2000, and its 2000 Quarterly Reports on Form 10-Q filed with the SEC. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. Additionally, Gilead does not take responsibility to update information contained in this press release or the conference call as it changes.

Other News

Some of the content on this page is not intended for users outside the U.S.